what is suta taxable wages

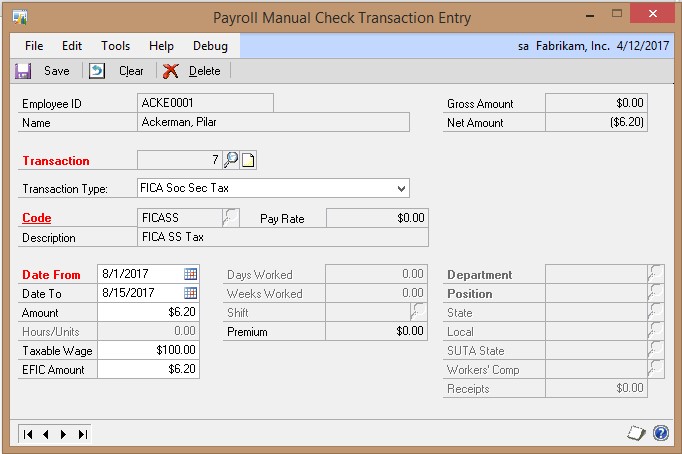

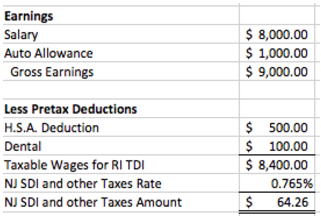

Generally unemployment taxes are employer-only taxes meaning you do not withhold the tax from employee wages. Employees must pay 765 of their wages as FICA tax to fund Medicare 145 and Social Security 62.

View All Hr Employment Solutions Blogs Workforce Wise Blog

In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636.

. What is the Current Taxable Wage Base. Utah employers are only liable for state UI taxes on wages paid to each employee up to the taxable. The new law reduces the.

However some states Alaska New Jersey and. For example in 2022 employers in the best positive-rate class were assigned a tax rate of 0207 percent and would pay only 9625 for each employee who makes at least the 2022 wage base. Employers are liable for unemployment tax in Virginia if they are currently liable for Federal Unemployment Tax.

In some cases however the employee. Base Tax Rate for 2022 from 050 to 010. Special Assessment Federal Loan Interest Assessment for.

The unemployment insurance tax is computed on the wages paid to each employee on a calendar quarter basis. Additional Assessment for 2022 from 1400 to 000. To calculate the amount of unemployment insurance tax.

Assume that your company receives a good assessment and your. During 2022 the taxable wage base is 4160000. If the employer paid.

Since your business has no history of laying off employees your SUTA tax rate is 3. To calculate the amount of tax to be paid by an employer multiply the amount of taxable wages paid during the quarter by the employers effective tax rate. 24 new employer rate Special payroll tax offset.

Taxable base tax rate. What is SUTA tax. The states SUTA wage base is 7000 per employee.

The State Unemployment Tax Act SUTA tax is typically a payroll tax paid on employee wages by all employers. General employers are liable if they have had a quarterly payroll of 1500. For 2022 this limit.

An employers tax rate determines how much the employer pays in state Unemployment Insurance taxes. Benefit wage charges BWC are the taxable base period wages reported by an employer to OESC through the quarterly wage reports which are not to exceed the annual limit. The current taxable wage base that Arkansas employers are required by law to.

You have employees with the. The reports and any payment due must be filed on or before April 30th July 31st October 31st and January 31st if the due date falls on a weekend or a legal holiday reports are due by the. Current Tax Rate Filing Due Dates.

The Medicare percentage applies to all earned wages while the Social Security.

What Is Suta Tax Definition Rates Example More

Suta Everything You Need To Know About State Unemployment Taxes Article

How To Pay State Unemployment Tax Suta Businessnewsdaily Com

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Please Refer To The Attachment To Answer This Question This Course Hero

Suta Vs Futa What You Need To Know

Tax Liabilities Report S247 Asap Help Center

Utah Unemployment Insurance And New Hire Reporting

Suta Vs Futa What You Need To Know

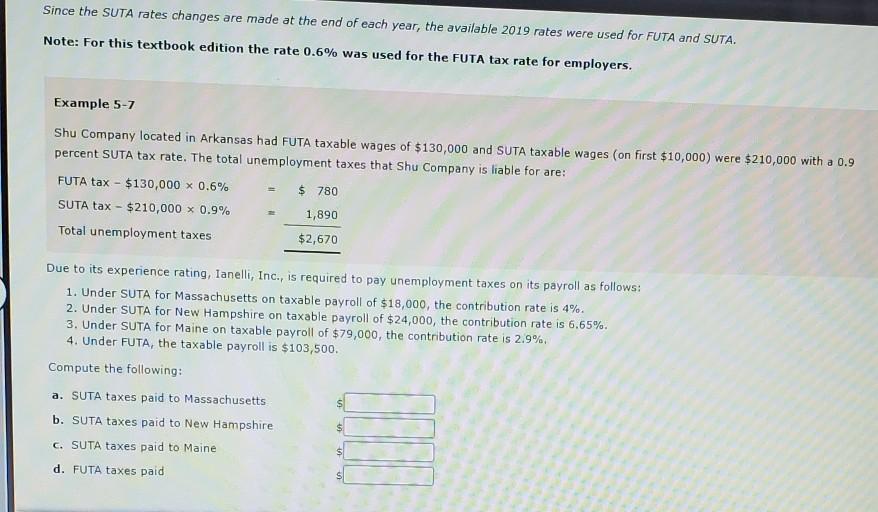

Solved Since The Suta Rates Changes Are Made At The End Of Chegg Com

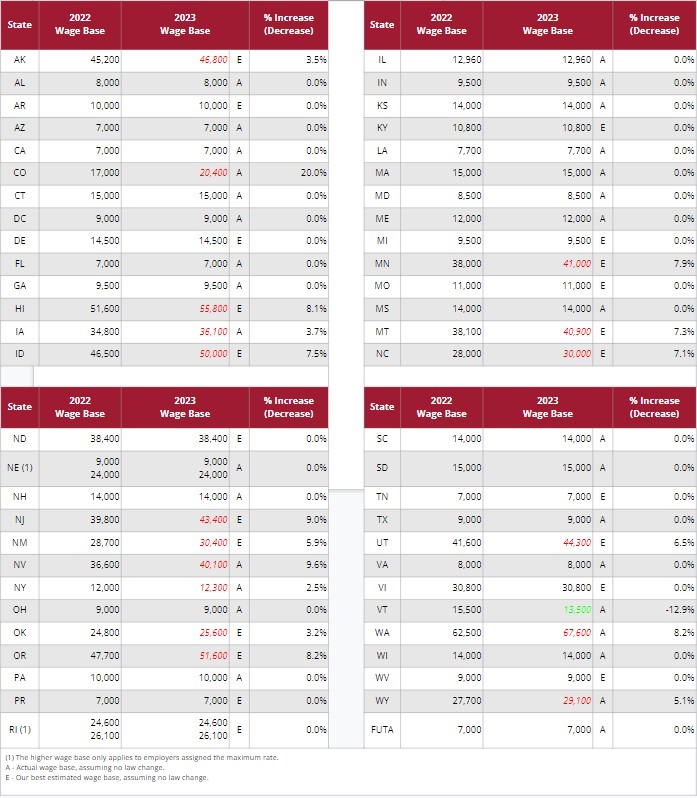

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Suta State Unemployment Taxable Wage Bases Aps Payroll

Suta Tax Your Questions Answered Bench Accounting

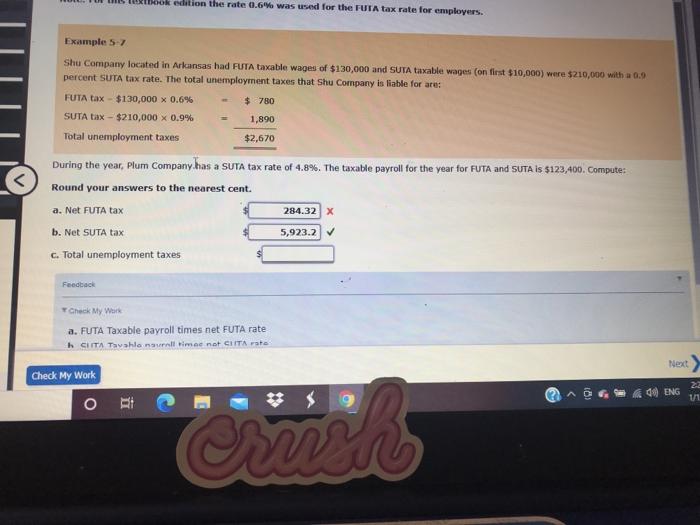

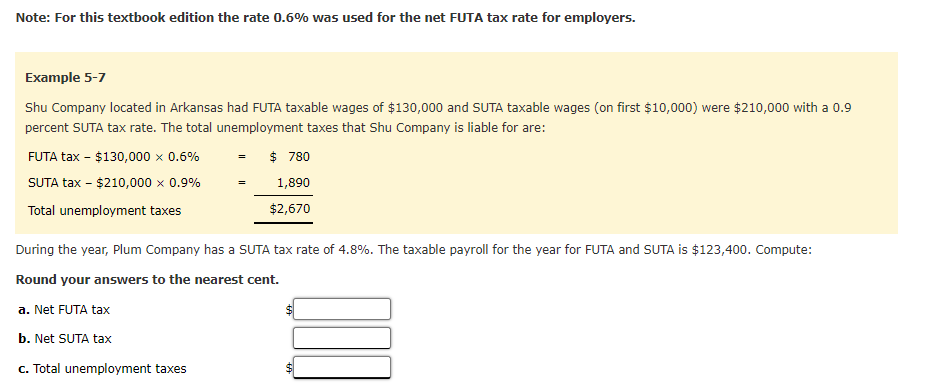

Solved Ook Edition The Rate 0 6 Was Used For The Futa Tax Chegg Com

Suta State Unemployment Taxable Wage Bases Aps Payroll

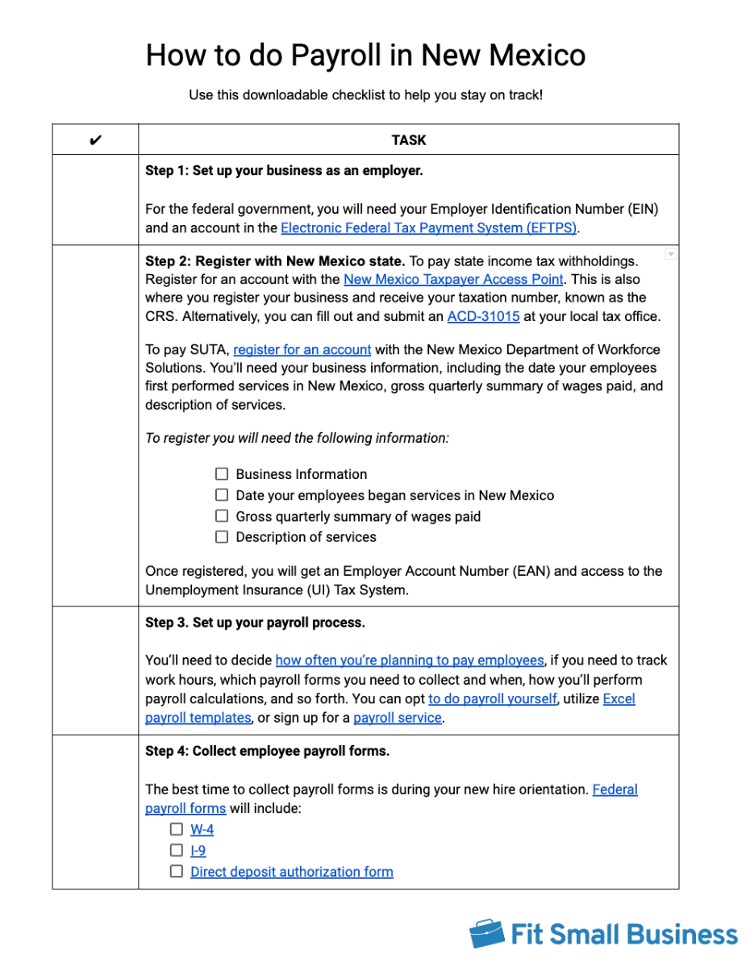

How To Do Payroll In New Mexico Everything Small Business Owners Must Know

Solved Note For This Textbook Edition The Rate 0 6 Was Chegg Com